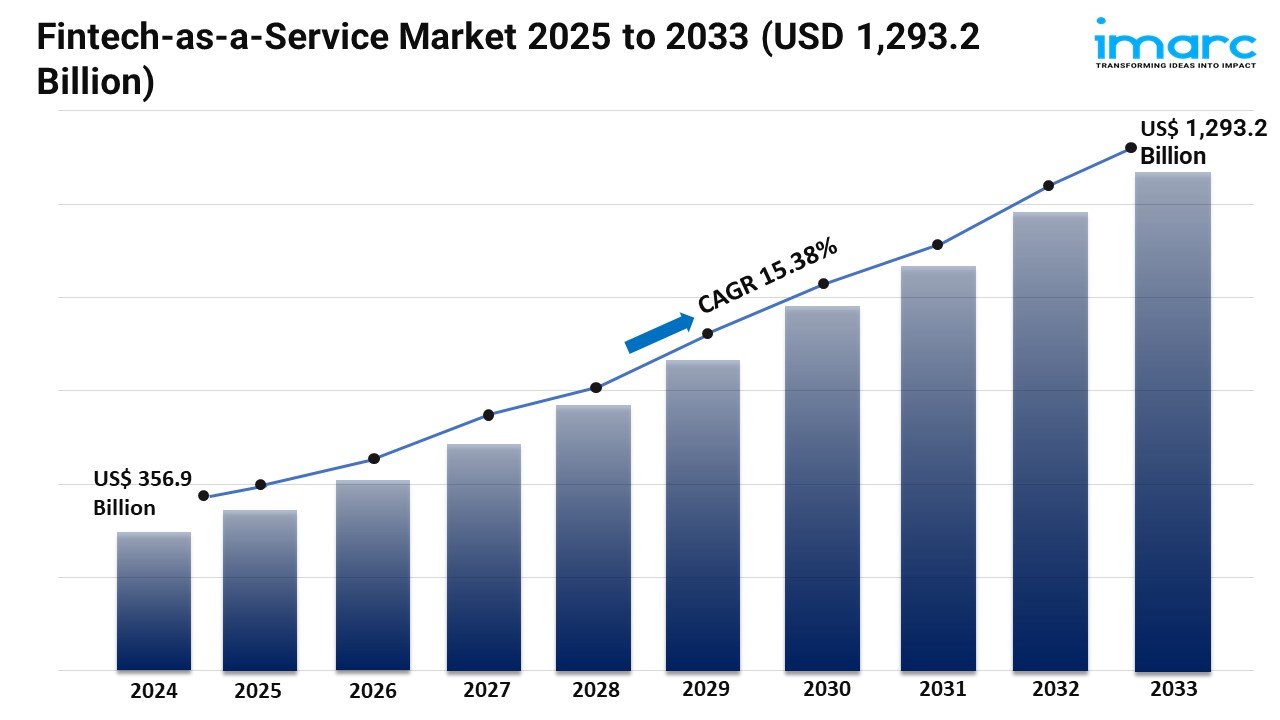

IMARC Group's report titled “Fintech-as-a-Service Market Report by Type (Payment, Fund Transfer, Loan, and Others), Technology (API, Artificial Intelligence, RPA, Blockchain, and Others), Application (KYC Verification, Fraud Monitoring, Compliance and Regulatory Support, and Others), End Use (Banks, Financial Lending Companies, Insurance, and Others), and Region 2025-2033”, Offers a comprehensive analysis of the industry, which comprises insights on the global fintech-as-a-service market share. The global market size reached USD 356.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,293.2 Billion by 2033, exhibiting a growth rate (CAGR) of 15.38% during 2025-2033.

Factors Affecting the Growth of the Fintech-as-a-Service Industry:

- More Companies Want Embedded Finance:

The fintech-as-a-service market is growing fast because many businesses now want to add financial services like payments, loans, or insurance directly into their apps or websites. This is called embedded finance. Customers today want quick and easy ways to handle money, and companies are using fintech tools to meet this need. By offering these services, businesses can make customers happier, keep them loyal, and earn more money. This trend is pushing traditional banks to improve and keep up. As more companies look for ways to stand out, the demand for fintech-as-a-service will keep rising, creating chances for both new and old players.

- New Rules and Challenges:

As the fintech market grows, governments are making new rules to protect people and keep things safe. Fintech companies must follow these rules while staying flexible. Those who handle the rules well will do better. There's also a growing need for tools that help businesses avoid breaking rules. This is pushing fintech providers to build strong systems that can adapt to new laws. Companies that focus on following rules will build trust and lead the market.

- Focus on Customers:

Fintech companies are now working harder to create solutions that focus on customer needs. As competition grows, they are offering personalized services to make customers happy and keep them loyal. People want financial services that fit their specific needs. By using data and technology, fintech providers can understand customers better and offer solutions that work for them. This focus on customers is improving experiences and building trust. In a fast-changing market, companies that put customers first are likely to succeed and grow.

Grab a sample PDF of this report: https://www.imarcgroup.com/fintech-as-a-service-market/requestsample

Leading Companies Operating in the Global Fintech-as-a-Service Industry:

- Block Inc.

- FIS, Inc.

- Fiserv, Inc.

- Mastercard Inc.

- PayPal Holdings, Inc.

- Railsbank Technology Limited

- Rapyd Financial Network Ltd.

- Solid Financial Technologies, Inc.

- Synctera Inc.

Fintech-as-a-Service Market Report Segmentation:

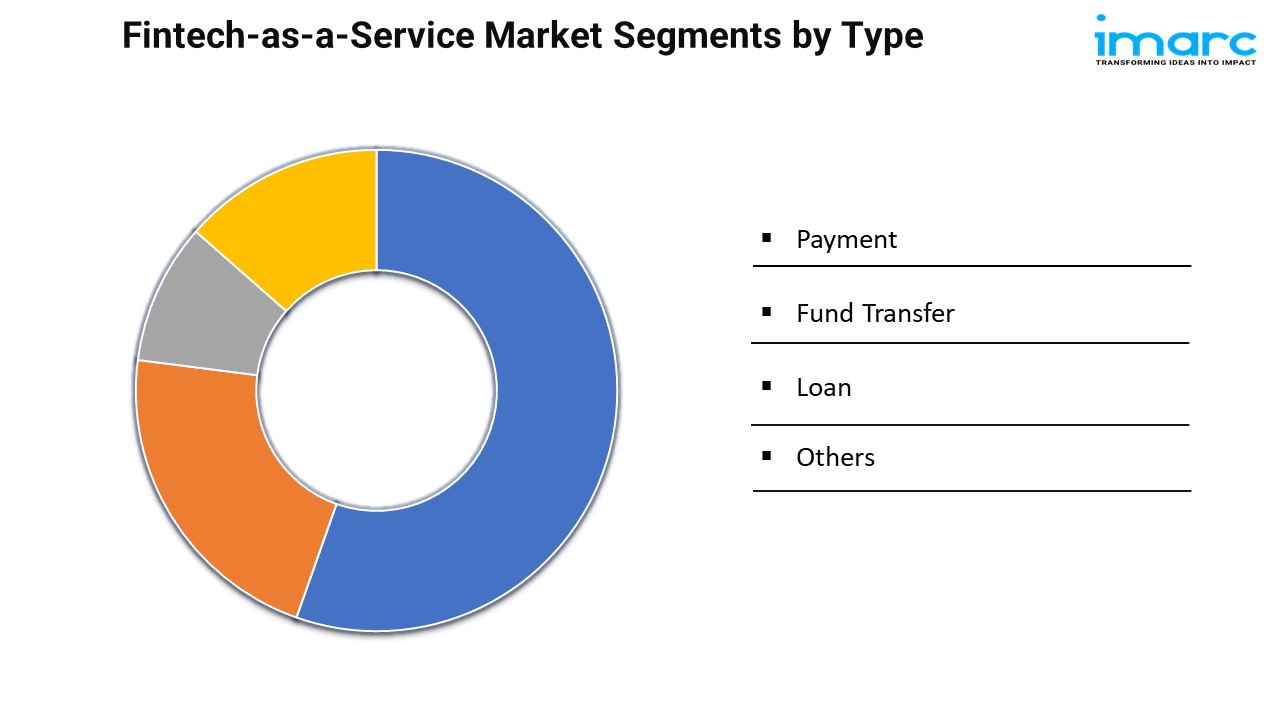

Breakup by Type:

- Payment

- Fund Transfer

- Loan

- Others

Breakup by Technology:

- API

- Artificial Intelligence

- RPA

- Blockchain

- Others

Breakup by Application:

- KYC Verification

- Fraud Monitoring

- Compliance and Regulatory Support

- Others

Breakup by End Use:

- Banks

- Financial Lending Companies

- Insurance

- Others

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Fintech-as-a-Service Market Trends:

The fintech-as-a-service market is growing because more businesses want to add financial services to their operations. By 2024, companies will use more flexible and easy-to-use fintech tools to make their financial processes faster and simpler. Many are moving away from traditional banking and using fintech platforms for services like payments and risk management. This change is happening because businesses need speed and efficiency. Fintech companies and traditional banks are also working together more to create new solutions. As businesses focus on better customer experiences and smoother operations, the demand for fintech-as-a-service will keep rising, changing how financial services are offered and used.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–631–791–1145